Platform Manipulation Part II: Rug-Pull Scams

Welcome to Platform Manipulation Part II: Rug-Pull Scams – a deep dive into the murky waters of social media fraud. With an ever-evolving digital landscape and an increasing dependency on social platforms, it’s time we pulled back the curtain on one of the most prominent deceptions infecting our feeds. As these platforms become the battlegrounds for financial trickery, we find ourselves in the crosshairs of a scam that merges financial manipulation and digital deception—rug-pull scams.

In particular, Twitter, with its sprawling, fast-paced universe, stands at the forefront of this battle, finding itself vulnerable to a rising tide of fake accounts and malicious bots. These nefarious forces prey on the uninformed, the overly ambitious, and the simply unlucky. It’s a world where a well-placed tweet can become a siren’s call, leading unwary investors into a trap with no easy escape.

In this article, we navigate this dangerous terrain, shed light on the murky corners of social media manipulation, and arm you with the knowledge you need to fight back. So, buckle up and get ready, as we uncover the reality of one of the most insidious and prevalent forms of social media scams today—rug-pull scams. Your financial safety and digital well-being could very well depend on it.

Understanding the connection between rug-pull and botting

Rug-pull scams, prevalent in the cryptocurrency world, involve the sudden and intentional withdrawal of funds contributed by investors, causing the project’s token value to plummet and leading to financial losses. Similarly, in the realm of NFTs, rug-pulling occurs when project creators swiftly liquidate the project’s assets, leaving investors with worthless tokens.

So, how do bots factor into this equation, and what is “botting” in this context?

In the web3 space, botting refers to the utilization of automated software programs or “bots” for specific tasks related to cryptocurrency or NFT projects. The aim is to gain an unfair advantage or manipulate the market. This can take various forms such as giveaways, whitelisting, and airdrops, but the underlying goal remains consistent: artificially inflating engagement numbers. By doing so, these projects appear as irresistible opportunities for unsuspecting investors.

Scammers often resort to spamming popular tweets to garner visibility for their fraudulent projects through engagement from others. In these instances, the tweet or account being targeted is referred to as “botted.”

It is crucial to recognize the significant impact bots have on social media platforms. According to Tauhid Zaman, an Associate Professor of Operations Management at Yale SOM, bots can be more active on Twitter than even abnormal human users. In a study on the first impeachment of Donald Trump, bots, comprising only 1% of active users, were responsible for 31% of the tweets.

This concerning trend over the past few years highlights the importance of taking preventive measures.

Have you been botted? Run your account audit and check! Audit your account>>

How can we detect botting or a rug-pull campaign?

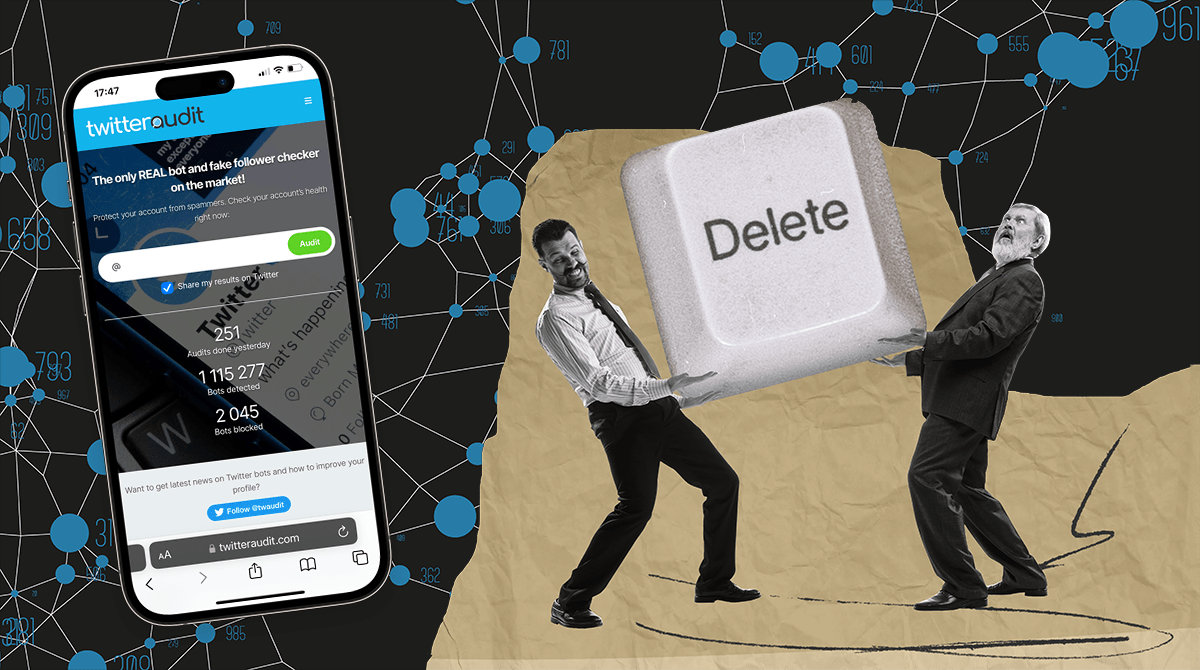

To safeguard yourself from rug-pull scams, conducting thorough research before investing in any project is paramount. However, this task can be daunting, especially without extensive IT resources. This is where social auditing tools like TwitterAudit come to the rescue.

TwitterAudit, available at twitteraudit.com, offers several functions to verify the authenticity of sources.

Analyzing Twitter Followers:

By analyzing a Twitter account’s followers, TwitterAudit provides an estimation of the percentage of genuine followers versus fake ones. This crucial information helps individuals identify accounts with a high proportion of fake followers—a potential sign of botting and a red flag for a rug-pull campaign. Such inflated follower counts often result from purchasing fake followers to artificially enhance popularity. Furthermore, the tool can identify accounts that boast a large number of followers but exhibit a low percentage of genuine followers.

Engagement Analytics:

TwitterAudit also features its own engagement analytics, enabling the gathering and highlighting of statistics from every tweet of suspicious accounts. This powerful functionality is particularly effective in uncovering fake projects. Unrealistically high engagement numbers contradict typical human behavior and serve as clear indications of bot manipulation. By leveraging the engagement analytics feature, users can effectively expose and identify bot activities, safeguarding their investments.

The significance of scrutinizing the authenticity of follower lists and analyzing engagement statistics cannot be overstated. These practices play a pivotal role in unveiling fraudulent web3 projects, empowering investors to make informed decisions and protect themselves from potential scams.

How big of a deal botting actually is?

The threat posed by web3 scams, especially rug-pull operations, has intensified over recent years. Atlas VPN reported a staggering $3.6 billion in cryptocurrency stolen through scams in 2021, marking an 81% increase from the previous year. In the NFT arena, CipherTrace identified $10.3 million lost to marketplace scams in the first three quarters of 2021 alone.

Quantifying the number of individuals affected by these scams is challenging due to the anonymity of crypto transactions. However, significant events, like the SaveDoge rug-pull, have impacted tens of thousands of investors, hinting at the scale of these operations.

These distressing statistics underscore the importance of user vigilance and the implementation of technological solutions like TwitterAudit.com. Recognizing the signs of potential bot manipulation and fraud can aid investors in navigating this increasingly complex landscape, mitigating risks, and safeguarding their assets. As we plunge deeper into the realm of cryptocurrencies and NFTs, education, diligence, and the effective use of available resources emerge as crucial defenses against these burgeoning threats.

Famous rug-pull events in the world of cryptocurrency

In recent times, several high-profile rug-pull events have shed light on the mechanics behind these fraudulent strategies. Examining these cases helps us grasp the tactics employed by scammers to deceive investors:

- Thugbirdz NFT project: November 2021 witnessed the rug-pull orchestrated by the creators of the Thugbirdz project. Investors were left reeling from a loss of over $1.5 million in cryptocurrency. The project had touted its 10,000 unique Thugbirdz NFTs as valuable assets. However, the rug-pull rendered these NFTs worthless, leaving investors empty-handed.

- SaveDoge: In June 2021, the creators of the SaveDoge NFT project unexpectedly pulled the rug, absconding with over $750,000 in raised funds. Investors were left with tokens that held no value.

- Spartan Group: February 2021 saw the Spartan Group, a decentralized finance project, executing a rug-pull maneuver. They liquidated their assets, resulting in the loss of millions of dollars for investors who had placed their trust in the project.

- PunkPanda: In August 2021, PunkPanda creators employed bot manipulation to artificially inflate demand for their NFTs. With skyrocketing prices and an influx of unsuspecting investors, they raised millions in funding. However, the rug-pull ensued, leaving investors with worthless NFTs while the creators vanished with the funds.

The key takeaway from these distressing incidents is evident: the implementation of preventive measures can be challenging without sufficient resources. This is where tools like TwitterAudit come into play. By leveraging platforms such as TwitterAudit, investors can fortify their defense against rug-pull scams like Thugbirdz, SaveDoge, Spartan Group, and PunkPanda, reducing the likelihood of falling victim to such deceitful practices.

The Role of the Web3 Community in Addressing Scams

The prevailing complacency in the web3 community towards scams signals a need for change. Prioritizing technological challenges and marketing over security may unintentionally foster a scam-friendly environment.

To combat this, we need to establish a culture of learning and vigilance, going beyond innovation to scrutinize credibility and risk. It’s crucial to conduct due diligence when supporting or promoting projects, share knowledge about prevalent scams, and emphasize security and transparency in our own projects.

The task of mitigating scams isn’t solely about avoiding financial losses. It’s about preserving the credibility of the web3 space. As we navigate this digital frontier, collective action is crucial to maintain the health and success of the web3 ecosystem.

Conclusion

The rising wave of rug-pull scams in the cryptocurrency and NFT realms underscores the crucial need for reliable tools to validate project legitimacy. TwitterAudit has emerged as a vital tool, enabling users to authenticate social media followers and expose potential scams. Simultaneously, the importance of due diligence and leveraging available resources cannot be overemphasized for mitigating the risks inherent in the cryptocurrency and NFT landscape.

However, the role of the web3 community in fostering a safer environment is equally essential. A culture of learning, vigilance, and due diligence, coupled with an increased focus on security and transparency in project development, is vital.

Maintaining a cautious approach remains indispensable in this ever-evolving ecosystem. It’s crucial to remember that if something appears exceedingly promising, it could potentially be too good to be true. As we traverse this digital frontier, vigilance, skepticism, and collective responsibility form the key to successfully navigating this landscape.